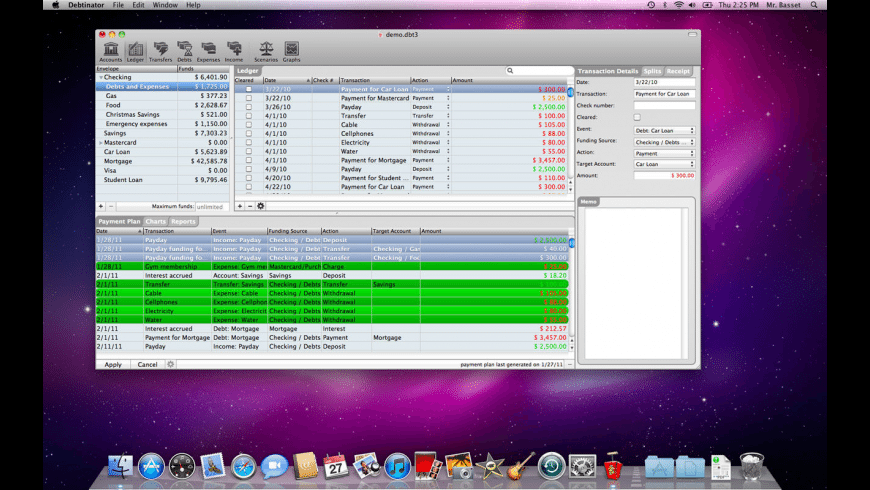

Debtinator overview

The savings can be huge. Let's say you earn $52,000/year, and have a few expenses (rent, gas, food). And you have a credit card with a $5,000 balance, a 15% interest rate, and a required monthly payment of $200.

Pay only the minimum, and you'll be paying it off for the next 2 1/2 years and spend $862.07 in interest! Or, you can punch it all into Debtinator, and be debt-free in 3 months, and only spend $92.32. You just saved $769.75! That $15.00 registration fee is looking better all the time, isn't it?

Debtinator doesn't judge, it doesn't care about your lifestyle, it doesn't tell you where to put your money. A lot of debt repayment schemes want you to make sacrifices. "If you just spend $25 less per month on dinner, you'll save thousands in interest!" Sure, that's awesome! If you want to do that, please do. It will definitely help.

But Debtinator doesn't require you to do that. All it cares about is how much money you have coming in, and how much money you have going out. You tell it where you want it to go, and then Debtinator takes care of it for you. Then, once your bills are paid, it re-shuffles all the excess money you have and uses that to pay down your bills.

Say your monthly income is $2,500. Rent is $500. You budget $300 for food. Household expenses (electricity, water, gas) are another $200. Car expenses (maintenance, gas) are another $150. Entertainment (movies, clothes, dinner) is another $100. And that credit card up there has a $200/month minimum. That's $1,450 you need to get by (including fun things!). But you're bringing in $2,500, so you have $1,050 unaccounted for.

It's amazing how quick that extra money can disappear. Go out to eat a few more times, buy a few more DVDs, and it's gone. Yeah, even that extra $1,050 that you don't need. You probably didn't even notice you had it or when it's gone. That's bad. Debtinator keeps track of it for you. It uses that extra money and re-allocates it as desired to pay down your debts lickety split.

What’s new in version 3.4.9

Updated on Mar 07 2019

- High sierra compatibility

- Re-enabled missing printing authorization

Information

License

Shareware

Size

4.6 MB

Developer’s website

https://www.bassetsoftware.com/debtinator/Downloads

26416

App requirements

- Intel 64

- OS X 10.10 or later

(0 Reviews of )

Comments

User Ratings