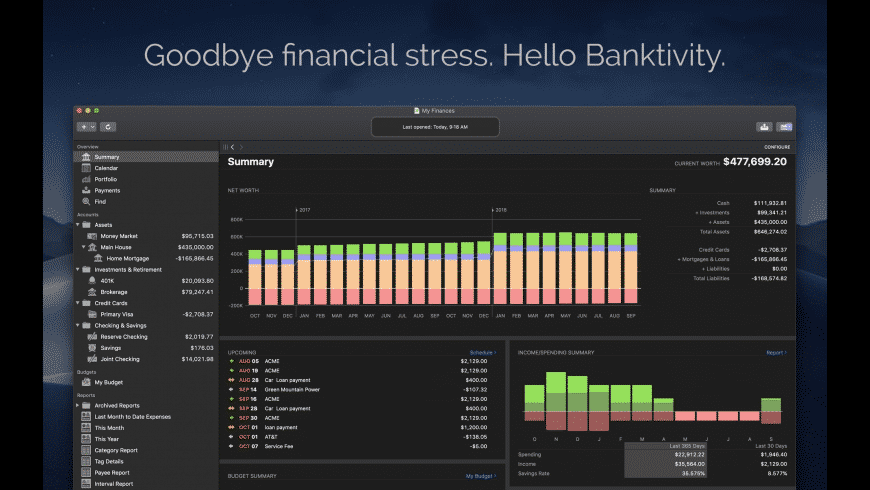

Banktivity

Intuitive personal finance manager; widget available (was iBank).

Banktivity overview

Banktivity (was iBank) is a new standard for Mac money management. With its intuitive user interface and a full set of money-management features, Banktivity is the most complete software available for Mac personal finance. It lets you enter and edit your transactions with ease, pay bills online and on time, download your online account data, reconcile your statements, and track your investments with versatile and robust tools.

In Banktivity, it's simple to split, schedule or categorize transactions. With a couple of clicks, you'll be able to create powerful, dynamic reports using Banktivity's flexible templates (Income and Expense, Net Worth, Forecast, and more). And Banktivity's new envelope budgeting feature helps tailor your spending while building savings.

What’s new in version 8.8.2

Updated on Jan 24 2023

- This version supports Open Banking connections with TD Bank.

Information

App requirements

- Intel 64

- Apple Silicon

- macOS 10.15 or later

What customer like

What needs improvements

(0 Reviews of )

Comments

User Ratings